If you want to take online payments, you need a payment gateway. It’s like a safe bridge for money. It collects your shopper’s info and moves money to your account.

There are many payment gateways out there. Each has good points and not-so-good points. This guide helps you pick the best one for your business.

Key Takeaways

- 51% of customers trust businesses more if PayPal is accepted

- Shopify Payments saves up to 2% on third-party payment gateway fees

- PayPal’s international transaction fee is 1.50%

- Stripe charges an extra 1% for international card transactions and currency conversion

- Shopify Payments processing fees range from 2.4% to 2.9% plus a 30¢ fee per transaction

What is a Payment Gateway?

A payment gateway is key for online stores. It connects your Shopify store to banks. It makes sure money moves safely from customers to you.

It keeps your customers’ financial info safe. This makes buying from you easy and safe.

The main job of a payment gateway is to check and okay transactions. It makes sure money goes from the customer to you safely. Here’s how it works:

- It gets the customer’s payment info, like credit card numbers, through your Shopify store.

- It makes this info safe from hackers.

- Then, it sends this safe info to the bank for approval.

- After, it tells your Shopify store if the payment was okay or not.

- Finally, it puts the money in your account, usually in a few days.

Using a payment gateway makes your online store safe, reliable, and follows rules. This makes your customers trust you more. It also helps stop fraud, which means more sales and happy customers.

| Payment Gateway | Payment Processing Fees | Additional Features |

|---|---|---|

| Shopify Payments | 0.6% – 2.9% + $0.30 per transaction | Currency conversion, fraud protection, seamless integration |

| Stripe | 2.9% + $0.30 per transaction | Advanced subscription billing, global reach, customization options |

| PayPal | 2.59% + fixed fee per transaction | Global recognition, easy setup, mobile-friendly |

“A payment gateway is the unsung hero of online commerce, securely processing millions of transactions every day and enabling the seamless flow of funds between customers and merchants.”

How Do Payment Gateways Work?

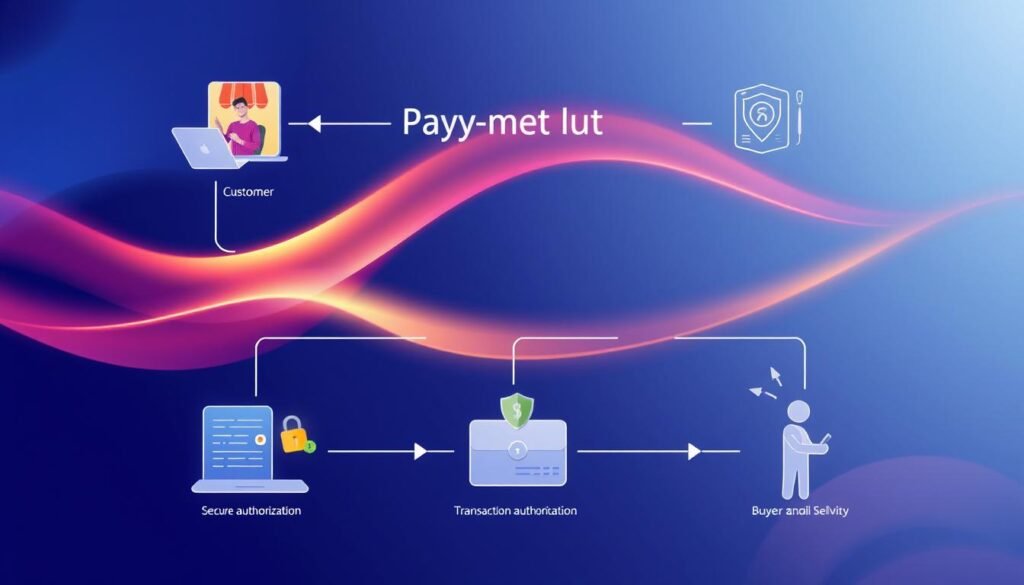

Payment gateways help make online payments easy and safe. They follow a few steps to move money from the buyer to the seller. Let’s look at these important steps in the Online Payment Processing journey.

- Customer Initiation: A customer buys something online and picks how they want to pay.

- Data Encryption: The buyer’s payment info, like credit card numbers, gets encrypted by the gateway. This keeps it safe from Fraud Prevention.

- Transaction Forwarding: The encrypted data goes to the payment processor or bank for checking.

- Authorization and Approval: The bank checks the payment. They might say yes or no.

- Fund Transfer: If it’s yes, the money moves from the buyer to the seller. This ends the Transaction Lifecycle.

This easy process makes sure payments are safe for both buyers and sellers. It helps businesses handle their online payment needs well.

| Payment Gateway | Processing Fees | Subscription Fees | Accepted Payments | Target Audience |

|---|---|---|---|---|

| Shopify Payments | 2.9% – 2.4% + $0.30 per transaction | None | Credit cards, digital wallets | Small to medium-sized businesses |

| Stripe | 2.9% + $0.30 per transaction (additional fees for manual entry, currency conversion, and international cards) | None | Credit cards, digital wallets | Businesses of all sizes, from startups to enterprises |

| PayPal | 3.49% + $0.49 per transaction (additional 1.5% fee for international payments) | None | PayPal, credit cards, digital wallets | Businesses of all sizes, with a focus on small and medium-sized enterprises |

There are many payment gateways for online stores. Each has its own features, prices, and who they’re for. It’s key for businesses to pick the payment gateway that meets their needs.

“Integrating the right payment gateway is crucial for optimizing your online payment processing and enhancing the overall customer experience.”

Top Payment Gateway Providers for Shopify Stores

Choosing the right Shopify Payment Gateways is key for a successful Shopify store. Shopify works with many Ecommerce Payment Processors and Online Payment Solutions. This gives merchants many options to meet their customers’ needs. Here are the top payment gateway providers for Shopify stores:

- Shopify Payments – Shopify’s own payment gateway. It’s easy to use and has fees based on your store’s plan.

- Stripe – Stripe charges a flat fee of 2.9% and $0.30 per transaction. It also has advanced features and works globally.

- PayPal – PayPal’s fees range from 1.9% to 3.4% for Shopify stores. It’s known worldwide and is trusted by many.

- Adyen – Adyen has a fixed monthly fee of 19 GBP for 350 transactions. It’s a good choice for cost-conscious stores.

- Authorize.net – Authorize.net charges a $49 setup fee and 2.9% + $0.30 per transaction. It’s a reliable option.

- WorldPay – WorldPay has two plans. The Basic plan costs 19 GBP per month, and the Premium plan costs 45 GBP. It meets different business needs.

When picking the right Shopify Payment Gateways, think about fees, security, global reach, and user experience. Offering many payment options can make customers happy and help your sales grow.

“A smooth and secure payment process is vital for any Shopify store’s success. The right payment gateway can greatly impact customer conversion and revenue.”

Shopify Payments

Shopify Payments lets online stores take payments online and in person. It’s part of Shopify Payments. You get lower fees, secure payments, and many payment options. Plus, there’s 24/7 customer service.

Features and Benefits of Shopify Payments

- Integrated with Shopify’s ecommerce platform for a seamless checkout experience

- Supports a variety of payment methods, including credit/debit cards, digital wallets, and local payment options

- Provides PCI DSS compliance, ensuring secure transaction processing

- Offers competitive payment processing rates for Shopify merchants

- Includes 24/7 customer support for any payment-related issues

- Automatically deposits funds into your bank account, with typical payout time of 3 business days

| Shopify Payments Pricing | Fees |

|---|---|

| Online Transactions | 2.9% + $0.30 per transaction |

| In-Person Transactions | 2.7% + $0.05 per transaction |

| Instant Payouts | 1% of the payout amount |

Shopify Payments is great for many merchants. But, it’s only for those who meet Shopify’s rules. If you don’t qualify, you can use other payment gateways like Stripe, PayPal, or Authorize.net.

“Shopify Payments has been a game-changer for our business. The seamless integration and competitive rates have helped us save time and money on payment processing.”

Stripe

Stripe is a great choice for Shopify merchants. It’s flexible and has lots of features. It’s good for businesses of all sizes.

Stripe’s Diverse Features

Stripe has many cool features for online stores. It handles international payments and fraud protection. It also makes subscription billing easy.

- It takes many payment types, like credit cards and mobile wallets.

- It works with many currencies, great for global businesses.

- It has strong fraud protection to keep your business safe.

- It makes subscription payments easy for your customers.

- It works well with many apps and platforms, including Shopify.

Seamless Shopify Integration

Shopify merchants can add Stripe easily. It lets them take credit card payments without extra fees. Stripe’s rates are the same as Shopify Payments.

To set up Stripe on Shopify, just follow a few steps. First, check if you can use Stripe. Then, log into Shopify and set up your Stripe account. Finally, turn on Stripe as your payment provider. This makes it easy to use Stripe’s great features with Shopify.

Stripe and Shopify work together well. They offer a great payment experience for your customers. This helps your business grow and succeed.

PayPal

PayPal is a well-known payment gateway for Shopify store owners. It has features like invoicing and buyer/seller protection. It also has a one-touch checkout. PayPal is available worldwide, making it easy for customers to buy from your store.

Advantages of Using PayPal

- High level of customer trust and familiarity with the PayPal brand

- Offers buyer and seller protection programs to safeguard transactions

- Provides an accelerated one-click checkout experience through PayPal Express Checkout

- Integrates with Venmo, allowing customers in the US to pay directly from the Venmo app

Disadvantages of Using PayPal

- Charges higher transaction fees compared to other payment gateways like Shopify Payments

- Requires a separate setup and checkout process from the Shopify platform

- Some merchants report issues with account freezes and fund holds by PayPal

PayPal Payment Gateway is great for reaching customers worldwide. It has buyer/seller protection. But, it has higher Transaction Fees and a separate checkout. Think about these points when choosing a payment gateway for your Shopify store.

Shopify Payment Gateways

Shopify stores have many payment options. Adyen Payment Gateway, Authorize.net Payment Gateway, and WorldPay Payment Gateway are top choices. They have different features and prices for your omnichannel payments and global payments.

Adyen Payment Gateway

Adyen is a global payment gateway. It lets you accept payments online, in-store, and on mobile. You can use many payment methods, like cards and digital wallets. It’s great for businesses with ongoing sales.

Authorize.net Payment Gateway

Authorize.net is easy to use with Shopify. It’s easy to set up and works with your Visa account. It supports many payment methods, including cards and digital wallets.

WorldPay Payment Gateway

WorldPay helps Shopify merchants with international payments. It works in over 150 countries and 120 currencies. It has fraud detection and mobile checkout. It’s good for stores with customers worldwide.

Choosing a payment gateway for your Shopify store is important. Look at fees, security, customer experience, and global reach. Each gateway has its own strengths. Pick the one that fits your business and customers best.

Choosing the Right Payment Gateway

When picking a payment gateway for your Shopify store, think about a few important things. Look at the fees, security, how easy it is to check out, and if it works with international payments. These help your business meet customer needs and run smoothly.

Checking the fees is key because they affect your profits. Shopify Payments has different fees for each plan. For example, the Advanced plan costs 1.5% + 25p GBP for online sales. Other big names like Stripe, PayPal, and WorldPay also have their own fees. You need to find the best one for your business.

Security is very important. Your customers’ money info must be safe. Make sure the gateway is PCI compliant and has good fraud tools. A smooth checkout process is also crucial. A hard checkout can make customers leave without buying.

FAQ

What is a payment gateway?

A payment gateway is a tech tool for online shops. It makes sure payments are safe. It encrypts info like credit card numbers and addresses.

How do payment gateways work?

Payment gateways work in steps. First, a customer pays on your site. Then, they enter their payment info, which gets encrypted.

Next, the info goes to the payment processor. The bank then says yes or no. If yes, the money moves to your account.

What are the top payment gateway providers for Shopify stores?

Top payment gateways for Shopify include Shopify Payments, Stripe, PayPal, Adyen, Authorize.net, and WorldPay. Each has its own benefits and costs.

What are the key features and benefits of Shopify Payments?

Shopify Payments lets merchants take payments online and in person. It works with many sales channels and has lower fees. It also keeps data safe and offers 24/7 help.

But, it’s only for Shopify users and charges extra for third-party payments.

What makes Stripe a popular payment gateway?

Stripe is popular because it works with many platforms. It lets merchants accept payments easily. It also has cool features like subscription billing.

But, it needs tech skills to set up and has high fees for chargebacks.

What are the advantages and disadvantages of using PayPal as a payment gateway?

PayPal is known and trusted. It has cool features like invoicing and protection for buyers and sellers. It also makes checkout easy.

But, it charges more than others, has a separate checkout, and some have issues with account freezes.

What other payment gateways are available for Shopify stores?

Other great options include Adyen, Authorize.net, and WorldPay. Adyen supports many payment methods and subscriptions. Authorize.net is easy to use and works with Visa.

WorldPay handles international payments in many countries and currencies. Each has its own perks and prices.

What factors should I consider when choosing a payment gateway for my Shopify store?

Look at fees, security, and how easy it is for customers to pay. Also, consider if it supports international payments and many currencies. Choose one that’s safe, affordable, and meets your customers’ needs.